18 April 2024

Employee ownership trusts (EOTs) are quickly becoming one of the fastest growing models of business in the UK.

Ian Haynes explains why more owner-managers than ever before are considering an EOT as part of their exit plan.

Since their inception, a little over a decade now, employee ownership trusts (EOTs) have steadily risen in popularity.

And when it comes to exit planning, nearly 20% of business owners say an EOT is their exit route of choice. It’s understandable why – EOTs come with a whole array of advantages for business owners looking to exit.

Most owner-managers will only exit a business once. So it’s really important to get it right. With that in mind, it’s crucial to pragmatically weigh up the pros and cons of using an EOT as your exit route, before diving in.

What is an EOT?

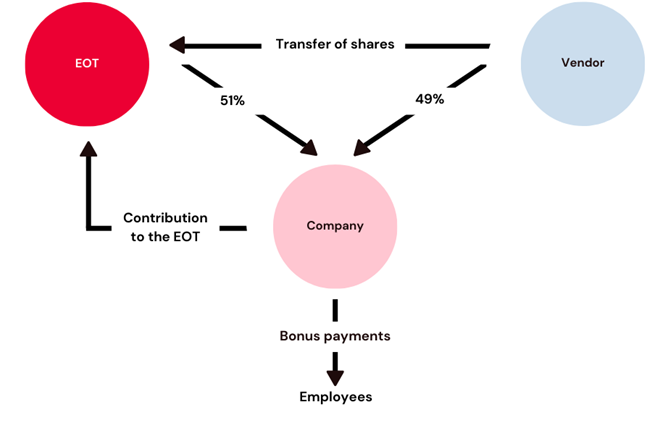

An EOT is an indirect form of employee ownership, where a benefit trust holds the controlling stake of your business on behalf of your employees.

The trust is placed above your company and all current shareholders sell more than half their shares to the trustee company that is within the EOT. The share purchase created a debt which is owed to the existing shareholders. Disposable income in your business can be used to make the initial payment. However, your business will need to continue generating profits each year to make EOT contributions, which repay the outstanding purchase price.

So, an EOT could be right for you if your business is mature and if your main priority is to protect your legacy and your team.

How can an EOT help to protect your legacy?

If you’re considering handing your business down to your current team, an EOT can be really beneficial in terms of protecting your legacy. They will know the ins and outs of your business, operations and values, so are much more likely to preserve your legacy than a third-party buyer.

This might lead you to ask why not just choose an MBO? The answer would be that an EOT is funded by surplus cash from the trading company’s balance sheet, whereas an MBO requires financial input from your team. This might not always be finically viable, meaning that they will need to secure external funding.

It’s really important to keep in mind that using an EOT for an exit will only work if your team is credible, and there is a solid management structure in place, or one is capable of being introduced. The team needs to care about your business and its future success. If not, it could taint your legacy, rather than preserve it.

A flexible exit route

One of the main benefits of an EOT is the flexibility. If you want a clean exit, you can sell all of your shares to the trust and leave the business in the hands of the remaining directors.

If you’re not quite ready to leave, or if you want to spend more time ensuring your team is ready to step up, you don’t have to sell all your shares up front. Meaning you can take a gradual step back over time.

The tax benefits of employee ownership trusts

By using an EOT as your exit route, you can make a complete capital gains tax (CGT) saving on the sale of your shares, as a gain arising on a sale to an EOT is not charged to CGT.

Where a business is sold to a third party, Business Asset Disposal Relief may be available, which allows each shareholder to be taxed on their first £1m of gains at 10%.

In the absence of BADR, or if your gain is larger enough to utilise it all, you could see yourself facing a capital gains tax bill of up to 20% in those circumstances. This can have a massive impact on the net cash left from the proceeds of your sale. So, the CGT benefits of an EOT are hugely beneficial.

That being said, it’s important not to be tempted by tax relief alone. If you’re planning on transitioning to an EOT solely for CGT purposes, it’s unlikely to be viable in the long term. You need to make sure it’s right for your team, exit goals and business.

What about the price upon sale?

Although exiting via EOT will offer you a fair, market-value price, it will likely be lower than an offer from an external buyer.

The money that shareholders receive upfront is limited by the cash reserves within the business at the time of sale. The rest of the payment is paid over several years.

If you’re looking for a lucrative lump sum upon your exit, attracting an external buyer or private equity firm might be a better route for you.

Supporting you with your exit plans

Leaving your business behind is by no means an easy decision to make. Inevitably, you will want to secure the best outcomes and achieve your long-term aspirations.

Like every exit route, EOTs will have their pros and cons, but your decision needs to be entirely unique to you.

The best way of ensuring you get the most out of your exit plans is to work closely with your advisors. They will be able to support you every step of the way and help you make informed, strategic decisions.

Our team of tax experts have helped to establish a number of employee ownership trusts within the region, and work with hundreds of other owner managers to ensure they realise their ambitions upon exiting. If you have any queries, or you’re looking for any further support, please feel free to get in touch.